what to do when you overpay a credit card

Credit cards are a great financial tool when used properly. They let you brand large transactions without having to carry effectually greenbacks. They besides offer great rewards programs that let you save money on your day-to-solar day spending.

Despite these benefits, credit cards are not free money. Every month yous'll get a pecker for the balance of your credit card. Ideally, you'll want to pay the bill in total, just most people have paid less than the full amount at some point in their life.

However, it is possible to do the opposite, paying more than the full amount due — resulting in a negative credit card account balance. Learn what happens when you overpay your credit card bill.

How You Cease Upwards Overpaying Your Credit Carte

The kickoff question yous're likely to ask is "how is it possible to overpay my credit card nib?" There are a few ways that this tin happen, some through no mistake of your own.

Transmission payments

Ane of the most mutual ways that you can wind upwardly overpaying your credit card pecker is by entering payment amounts manually.

Every credit card issuer that has an online payment system gives you lot options on how much y'all desire to pay when you make a payment. Usually, they offering the option to pay the full corporeality, the minimum balance, or a custom amount. Usually, y'all employ the custom amount option when yous desire to pay more than the minimum but less than the full residual.

If you enter the amount you'd like to pay incorrectly, whether it be by swapping or adding an actress digit, you tin can pay more than y'all owe. Many card companies limit you to paying no more than than the total residue, but some exercise let you to overpay. If this happens, y'all'll air current up sending more coin to the credit menu company than you owe them.

Another way to do this is if you brand your payments past concrete cheque. If you lot write the wrong amount on the bank check, the bill of fare visitor volition get paid more you owe them.

Boosted payments on top of automatic payments

Another common way that credit card bills become overpaid is when people brand a manual payment when they have automatic payments prepare up. Near card issuers offer the option to set up autopay for your monthly bill. This is a great characteristic because it removes the stress of remembering your bills' due dates. You'll never pay a late payment fee when autopay is turned on since the carte du jour company volition withdraw the money from your bank account for you lot.

If you're like me, y'all sometimes like to pay off your credit menu residual during the calendar month without waiting for your statement to come in. If you have automatic payments turned on, this tin can result in backlog payments. If your autopay is scheduled to get through on the 2nd of the calendar month, and you make a transmission payment on the 1st, the arrangement might not recognize that your card's balance has changed. Your automatic payment will and then go through for the bill of fare's old balance.

Refunds and credits

The 3rd way you can overpay a credit bill of fare is by receiving a refund. Picture this scenario.

On the 15th of the month, you buy a new vacuum from the shop. You lot utilize information technology and it works cracking, so when your credit card bill comes on the 30th, you pay it right away. A few days later on, the vacuum breaks. You bring it back to the store and ask for a refund. The store gives you the refund by crediting your card.

In this scenario, yous wind up with an overpaid credit card, even though you paid exactly what you lot owed at the time.

A similar case involves credit offered as a credit card do good. For case, a travel rewards credit carte might provide argument credits toward incidental airline fees.

What Happens if You Overpay Your Credit Carte

If yous overpay your credit card your business relationship's remainder will get negative. That means that the card visitor owes you money, rather than you owing the card company money.

Avoid information technology if possible

Overpaying your credit bill of fare isn't the worst affair to do, but it's even so non a good affair to do.

For i, you don't want the credit card company holding your coin. Every dollar that is sitting in the credit card company's business relationship instead of yours is earning the company interest instead of you. Plus, the money is tied up and relatively inaccessible to you. If you need cash to pay bills and you have a lot of money tied up in overpaid credit card balances, you might air current up in financial trouble even if you lot would have been able to pay the bills.

How to Handle an Overpaid Credit Card

Not sure what to practise with an overpaid credit card? The proficient news is yous have a few options to fix the situation.

Spend it

When you overpay your credit card, you're essentially pre-paying for your hereafter expenses. The easiest thing to exercise is to only go on using the credit card. All of your future purchases will exist applied towards the negative balance you've congenital up. Once your balance is dorsum to the point where you owe coin over again, yous can continue making payments as usual.

Ask for a check

Fifty-fifty though y'all sent the money to the card issuer, the money is still technically yours. While overpaying a card isn't common, it also isn't as uncommon as yous would think. Nigh credit carte du jour companies will be happy to refund you the overpaid corporeality by sending you a bank check. All you accept to do is contact the company by phone or e-mail and request a bank check for the rest.

Do nothing

While this is the slowest and least-recommended selection, you can cull to practice nothing about your negative credit carte du jour balance. Legally, credit menu companies must make a good-faith effort to event a refund of the negative balance after half dozen months of the card being unused.

The reason this is not recommended, other than the fact that it takes six months to get the refund, is there'south no guarantee yous'll get the money dorsum. The bill of fare company will effort to refund y'all, but if yous've moved or something prevents them from contacting you, you won't become the refund.

Does an Overpaid Balance Touch on Your Credit Score?

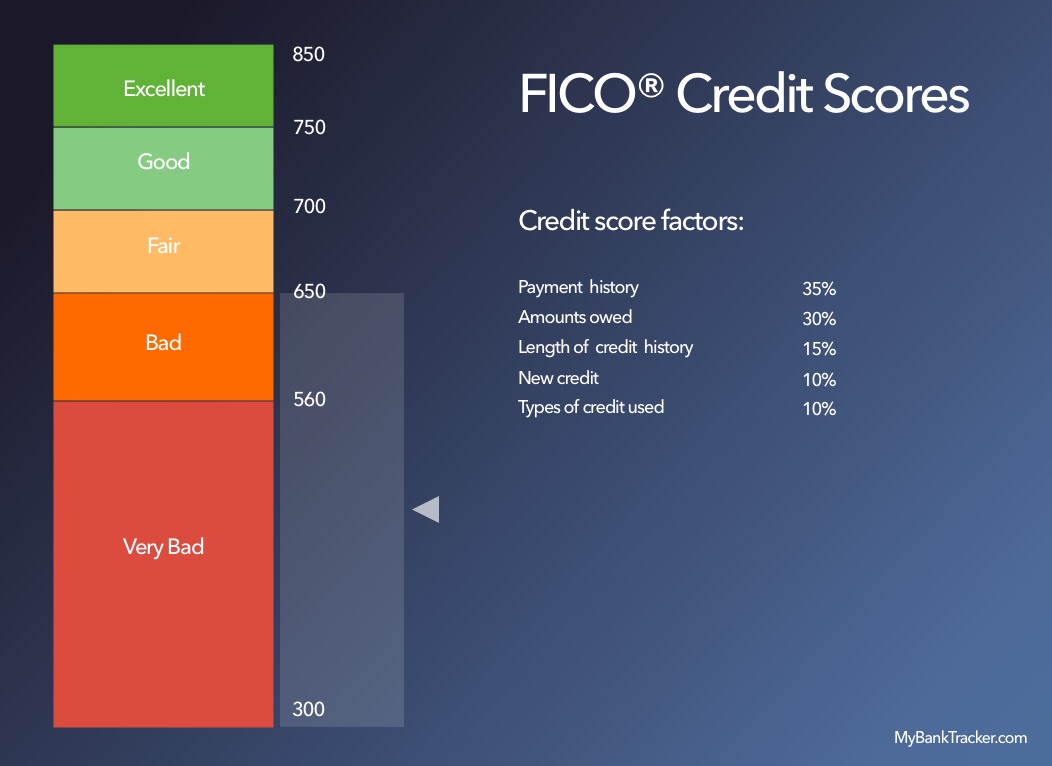

Given that your credit bill of fare balances affect your credit score, an overpaid balance tin can only help your credit, correct? In fact, a negative credit carte du jour balance has the aforementioned outcome on your score as a rest of $0.

The lower your credit utilization the improve, so having a negative remainder is better than having a huge residuum, but in that location is no special benefit to overpaying.

Potential Fraud Alerts

Ane large reason to avoid overpaying your credit card residual is the potential for your account to exist flagged for fraud.

Overpaying a credit card is an unusual thing to exercise. Some companies allow you to prepay your menu if you want to make a purchase that exceeds your credit limit, so it tin can sometimes be a sign of a big buy coming up.

If you of a sudden overpay your menu by a large amount, specially if you use a new that could worry a card issuer. They could suspect that a fraudster has gotten admission to your card account and plans to use it without your permission. That could event in your account being shut down temporarily, or even permanently.

How to Handle a Fraud Warning

If your card is flagged for potential fraud and shut down, don't panic.

The first matter to practice is to achieve out to the card issuer'south client support line. Explicate the situation to them and tell them that you lot simply made a mistake when paying your credit card bill. Be sure to answer any questions that they have accurately and in total. If the lender is really worried about fraud, they'll desire to confirm that they're really speaking to y'all and not someone who has stolen your identity.

Once you've gone over the situation with the company's support staff, they'll be able to reactive your account.

In the worst example, if your account is shut down completely, it's however worth calling. The menu issuer might be able to reopen the account. If they cannot, start shopping around for new credit cards. Overpaying your card won't have impacted your credit, and yous might have the take chances to earn a valuable credit bill of fare sign-upward bonus.

Conclusion

It is possible to overpay your credit carte, but information technology by and large isn't something you should do on purpose. Information technology offers no real benefits and ties up your greenbacks in the credit card issuer's account. Make sure to avoid overpaying past carefully entering the correct numbers when paying, or relying on autopay to make payments for y'all.

Source: https://www.mybanktracker.com/credit-cards/faq/what-happens-overpay-credit-card-273852

0 Response to "what to do when you overpay a credit card"

Post a Comment